Will the Euro ever replace US dollar as the main global currency?

The U.S. dollar remains the dominant global reserve currency and the primary currency used for international trade transactions. While the euro is the second most widely held reserve currency and is used extensively in international trade, it has not yet replaced the U.S. dollar as the main global currency.

Predicting the future of global currencies is complex and subject to numerous economic, political, and geopolitical factors. Whether the euro will eventually replace the U.S. dollar as the main global currency is uncertain and depends on several key factors:

-

Eurozone Stability: The stability of the Eurozone economies is crucial for the euro's international standing. Economic stability and consistent monetary policies are attractive qualities for a reserve currency.

-

Size of the Eurozone Economy: The size and strength of the Eurozone's combined economy play a significant role. A larger and more robust economy can provide the necessary depth and liquidity to support a global reserve currency.

-

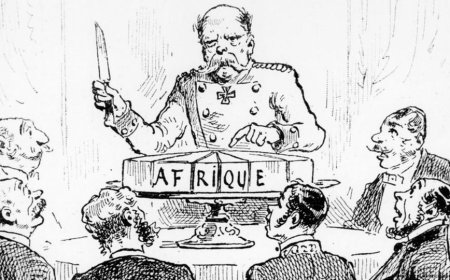

Geopolitical Considerations: Geopolitical developments and international relations can influence the global demand for a currency. Geopolitical events that affect the confidence in the U.S. dollar or the euro could potentially shift the balance.

-

Financial Market Infrastructure: The availability and efficiency of financial markets in the Eurozone are essential for the international use of the euro.

-

Euro's Internationalization: Efforts by the Eurozone countries to promote the international use of the euro, such as in trade agreements or financial transactions, can influence its status as a global currency.

-

Currency Preferences of Nations: Other nations' preferences for holding and using specific currencies in their reserves and trade can also influence the global currency landscape.

While the euro has made significant strides since its introduction in 1999, it faces challenges that limit its potential to replace the U.S. dollar in the near term. Some of these challenges include the lack of a unified Eurozone bond market, diverging fiscal policies among member countries, and the absence of a unified European government.

That said, the global financial landscape is dynamic, and changes can occur over time. Central banks and international organizations are increasingly advocating for a more diversified international monetary system to reduce reliance on a single dominant currency. This could open up opportunities for the euro, as well as other currencies, to play a more significant role in the global financial system in the future. However, the U.S. dollar's position as the world's primary reserve currency is deeply entrenched and would not change overnight.